Newfoundland Banking Institutions and Currency

Newfoundland Banking Institutions and Currency

By C.F. Rowe

Spring, 1981

Reprinted Fall, 1991

[Originally published in printed form]

From: Rowe, C.F. 1967. The Coins and Currency of Newfoundland IN The Book of Newfoundland, vol. 3. Reproduced by permission of Newfoundland Book Publishers.

For a long time in Newfoundland's history, actual cash was scarce. The only medium of exchange for the great majority of Newfoundlanders for food, clothing and other necessities was dried cod fish, which has often been referred to as "Newfoundland currency". The merchants carried out their business on what was known as the credit or truck system. They outfitted the fishermen in the spring, for which the fishermen paid with dried fish in the fall.

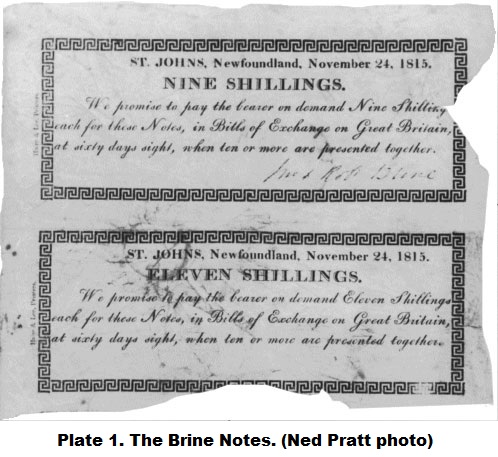

In the late 1700's, with the increase in population, coin became more common. It consisted mainly of British currency, but coins of other countries were also in circulation. As well, Notes valued from five pounds to five shillings were available. Large transactions between firms were usually covered by Bills of Exchange, transferred from one firm to another in much the same way as bank Notes are exchanged today.

One of the earliest bills presented to the Newfoundland Legislature, and one which received the unanimous support of all members of the House, was a Bill for the establishment of a Savings Bank. Passed on June 12, 1834, this Bill contained various regulations governing savings accounts, including the provision that a deposit could not be less than one shilling or more than fifty pounds. The Bank was an immediate success and continued to grow and prosper over the next 130 years until it was finally sold at a considerable profit by the Newfoundland Government to the Bank of Montreal on March 31, 1962.

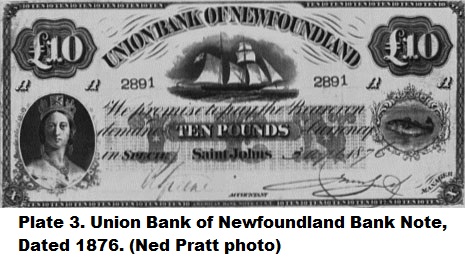

Approximately three months after the opening of the Newfoundland Savings Bank, an Act was passed on September 20, 1834, authorizing the Treasury to issue Treasury Notes. By this Act, Newfoundland had legalized currency for the first time. All of these Notes were recalled, cancelled and destroyed by 1857. It is not known if any of these Treasury Notes are in existence today except for a few partially signed and a few blank copies of the one pound Note. The withdrawal of the Notes from circulation was probably due to the establishment of other banks, namely the Bank of British North America, the Union Bank of Newfoundland and the Commercial Bank of Newfoundland between 1837 and 1857.

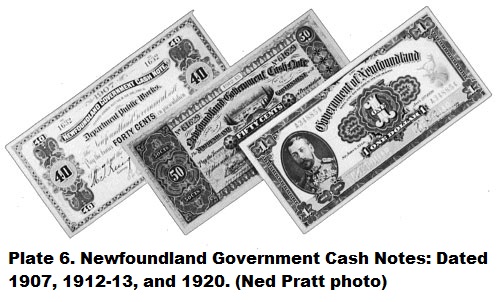

In 1901 the Government of Newfoundland, through its Department of Public Works, issued a series of Cash Notes. These Cash Notes were in denominations of forty, fifty and eighty cents and one and five dollars and were limited to the amount of money voted by the Legislature for Public Works each year. The value of the Note was probably tied in with the rate of wages for road work, which at the time was twenty cents an hour. They were printed in black on white paper with the date printed in red and signed by the Minister and Secretary of the Department of Public Works. They were also signed by the Chairman of the Local Roads Board when he had occasion to use them.

n 1910 a more elaborately-designed and coloured Note was placed in use according to the years 1910-1911, 1911-1912, 1912- 1913 and 1913-1914. The denominations were twenty-five cents, one dollar, two dollars and five dollars. Again, the amounts printed were dependent on the vote of the Legislature for public works. Both series of Notes were redeemable at the Bank of Montreal in St. John's, the official bankers for the Newfoundland Government.

After a lapse of six years, there was one final issue of Newfoundland Government Notes. These were of one and two dollar denominations and were dated January 2, 1920. The one dollar, printed in blue, shows a portrait of King George V to the left and the head of a caribou on the right. The two dollar, printed in brown, shows a mining scene in the centre with the head of a caribou on the right. Both Notes bear the official seal of the Colony with a ship and anchor on either side. By law, the Newfoundland one dollar and two dollar Notes were the only Notes below five dollars allowed to circulate on the island.

After a lapse of six years, there was one final issue of Newfoundland Government Notes. These were of one and two dollar denominations and were dated January 2, 1920. The one dollar, printed in blue, shows a portrait of King George V to the left and the head of a caribou on the right. The two dollar, printed in brown, shows a mining scene in the centre with the head of a caribou on the right. Both Notes bear the official seal of the Colony with a ship and anchor on either side. By law, the Newfoundland one dollar and two dollar Notes were the only Notes below five dollars allowed to circulate on the island.

The first commercial bank to serve the growing needs of the population of St. John's was the Bank of British North America. This bank was established early in 1836 when a group of wealthy English businessmen met in London to discuss the possibility of founding a bank in Canada. It was resolved at the meeting, held on March 4, 1836, that due to the importance of trade with the Colonies, the formation of banks in Quebec, Montreal, Halifax, Sydney and St. John's should be considered. Mr. Andrew Milron was sent out to organize the St. John's branch late in 1836. He opened for business in a building located where the East End Post Office now stands.

Having found it inconvenient to operate under provincial statutes, the Bank of British North America applied for and received a Royal Charter in 1840. The issue of Notes by this bank is uncertain since no record for Notes used only in Newfoundland is available. In his book, Newfoundland in 1842, Sir Richard Bonnycastle refers to the Bank of British North America as being the only commercial bank carrying on business and issuing its own local Notes.

Several attempts were made by local businessmen to establish a local bank of their own. Local merchants and traders felt that the services they required were not adequately covered by the Bank of British North America. By December 1853, this movement had progressed to the stage where there appeared no doubt that the bank would go ahead. Toward the end of January, 1853, the amount of shares subscribed assured the establishment of a bank.

Several attempts were made by local businessmen to establish a local bank of their own. Local merchants and traders felt that the services they required were not adequately covered by the Bank of British North America. By December 1853, this movement had progressed to the stage where there appeared no doubt that the bank would go ahead. Toward the end of January, 1853, the amount of shares subscribed assured the establishment of a bank.

On February 8, 1854, the following notice appeared in the Times:

----

UNION BANK OF NEWFOUNDLAND

The requisite number of shares having been subscribed in the above Institution, Stockholders are requested to meet in the Committee Rooms, Exchange Building, on Saturday 18 inst. at one o'clock for the election of Provisional Directors pursuant to the 11th Dule of the Prospectus.

William Thomas

Chairman of the Provisional Committee

----

The Union Bank opened for business on May 23, 1854, and an Act to incorporate the Union Bank of Newfoundland was passed on November 30, 1854. With the support of the local merchants, the success of the bank was assured; and within three years, it put the Bank of British North America out of business. Large profits were made and shareholders saw their stock rise to many times its original value.

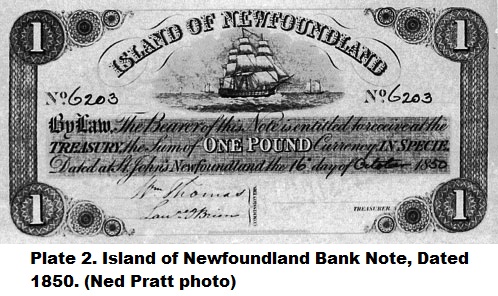

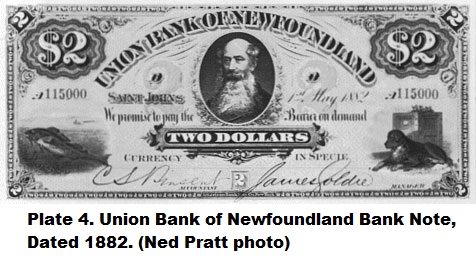

The Notes of the Union Bank were first issued in pound denominations (the Newfoundland pound was equivalent to four dollars in sterling). They were all of approximately the same design but printed in different colours for each denomination [Plate 3]. On May 1, 1882, a new series of two dollar notes was introduced to be followed by higher values of five dollars, ten dollars, twenty dollars and fifty dollars on May 1, 1889. Like the earlier Notes, they were of beautiful design and workmanship with the two dollars displaying the portrait of J.W. Smith, the first Manager [Plate 4].

The Notes of the Union Bank were first issued in pound denominations (the Newfoundland pound was equivalent to four dollars in sterling). They were all of approximately the same design but printed in different colours for each denomination [Plate 3]. On May 1, 1882, a new series of two dollar notes was introduced to be followed by higher values of five dollars, ten dollars, twenty dollars and fifty dollars on May 1, 1889. Like the earlier Notes, they were of beautiful design and workmanship with the two dollars displaying the portrait of J.W. Smith, the first Manager [Plate 4].

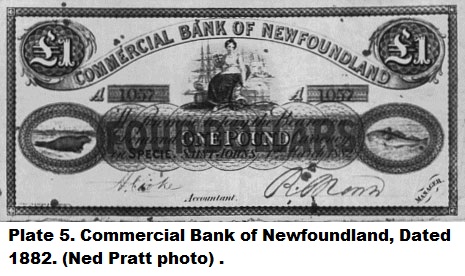

The closing of the Bank of British North America and the very successful operation of the Union Bank were probably factors influencing St. John's merchants, who were neither clients of the Union Bank nor shareholders in it, to form another local bank. A prospectus for the formation of the Commercial Bank of Newfoundland was quickly subscribed, and the bank was incorporated on April 10, 1858, when "An Act to Incorporate the Commercial Bank of Newfoundland" was passed.

Decimal coins were introduced in Newfoundland on January 1, 1865; but the pound Notes continued in use for many years afterwards. It was not until 1877 that a law was passed requiring accounts of the Newfoundland Government to be kept in dollars and cents. The Newfoundland pound had a value of four dollars local currency. When the decimal system was first introduced, a special Note was issued showing its value in both pounds and dollars. The one pound Notes bore the words four dollars and the five pound Notes the words twenty dollars across their face in a boldly contrasting colour. This series was short lived - on July 1, 1884, a new series was introduced in dollars only.

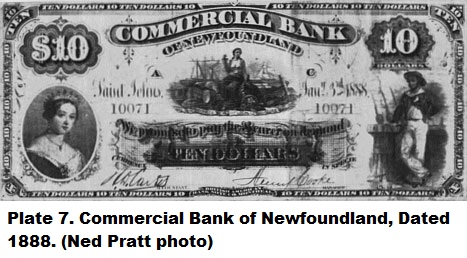

The fourth and final series of Notes to be issued by the Commercial Bank came into use on January 3, 1888. They were striking colours and design, which for the first time carried over into the reverse as well. The denominations were for two dollars, five dollars, ten dollars, twenty dollars and fifty dollars. In the case of two dollars, there were tow varieties: one having a bright orange seal as a background in the centre and the other a green background.

The fourth and final series of Notes to be issued by the Commercial Bank came into use on January 3, 1888. They were striking colours and design, which for the first time carried over into the reverse as well. The denominations were for two dollars, five dollars, ten dollars, twenty dollars and fifty dollars. In the case of two dollars, there were tow varieties: one having a bright orange seal as a background in the centre and the other a green background.

The story of the Bank Crash of 1894 - Black Monday - was summed up by the Hon. P.T. McGrath, writing forty years later in the National Magazine: "On December 10, 1894, this Island, Britain's oldest Colony, was visited by a bank disaster, which in the extent and completeness of the ruining caused was most appalling. The commercial community was stricken almost to death, but the area of ruin wrought was as wide as the Colony itself. The Government, having no official Note issue, did all its business and discharged all its obligations with the two banks. Their Notes were found in every household around the Coast: the wretched fishermen on the bleak coast of Labrador carried a few of them, comprising his whole earthly possessions, in a bag around his neck; while the merchant prince in St. John's had his safe filled with them ... now, at one fell stroke, it was rendered worthless. Winter with all its hardships was approaching, the trade of the Colony was demoralized, concerns which had not yet collapsed knew not the moment when they would go under, labour ceased, factories closed down, and a cry for food went up from the plundered multitude.

The Commercial Bank failed to open on the morning of the 10th. The Union Bank opened for a short time. The Savings Bank had first lien on the specie of the Union Bank and absorbed what little cash there was on hand. It was this action which was said to be the immediate and compelling cause for the Union Bank to close.

At various times in the 19th-early 20th centuries, private companies used token or private money to pay their workers. This private money was redeemable for merchandise, usually at the company store. In some cases, arrangements were made with other stores who would agree to accept the Notes, probably for a percentage from the issuer. Bowring Brothers Ltd., Reid Contract Co., Job Bros. and Co. and Betts Cove Mining Co. in Notre Dame Bay all followed this practice.

Newfoundland did not have a coinage of her own until 1865. Prior to this, the coinage in circulation was mainly British, but there were also large quantities of coins brought in by various European fishermen and trading vessels. They came to Newfoundland in the fall to purchase fish which they paid for in silver and gold of their own country.

Gold coins were actually worth their weight in gold, and it was a practice to chip or clip a small piece of gold off coins. Gold coins would also lose a certain amount of their value due to ordinary wear and tear, and anyone exchanging goods for a gold coin would not be receiving full payment for his goods if the coin was worn or chipped. To overcome this problem, balances were designed to weigh the coin; and a rider on the balance would indicate how many pence were to be deducted from the face value of the coin if it were found underweight.

One of the strongest proponents of the introduction of a coinage for Newfoundland was William Solomon, the Postmaster General, who claimed that the loss sustained by the lack of a permanent copper currency was having a serious effect on the revenue of the Post Office. Under the Currency Act of 1851, five hundred pounds worth of Newfoundland coins were authorized. In 1863 another Act established the money of Newfoundland as dollars and cents and decreed that all public accounts were henceforth to be kept in dollars and cents.

The first regular issue of coins was dated 1865 and consisted of one cent, five cents, ten cents, twenty cents and what is commonly called a two dollar gold piece but actually bears the inscription two hundred cents - 100 pence. The fifty cent denomination was not introduced until 1870 and the twenty-five cent, which replaced the twenty cents, did not appear until 1917. Coins were not made annually but only as the need arose, and then only values for which a shortage existed.

The first regular issue of coins was dated 1865 and consisted of one cent, five cents, ten cents, twenty cents and what is commonly called a two dollar gold piece but actually bears the inscription two hundred cents - 100 pence. The fifty cent denomination was not introduced until 1870 and the twenty-five cent, which replaced the twenty cents, did not appear until 1917. Coins were not made annually but only as the need arose, and then only values for which a shortage existed.

The completed set of Newfoundland coins is considered to match any of the most beautiful coin sets in the world for both beauty of design and workmanship.

This is also true for Newfoundland's paper money, much of which was either lost or destroyed in the Great Fires. A recent article in the Canadian Numismatic Digest comments that the serious collector trying to obtain a bare minimum of representative currency of Newfoundland could have set himself an impossible task, for Newfoundland money has very nearly ceased to exist. Most of it is in the hands of collectors.